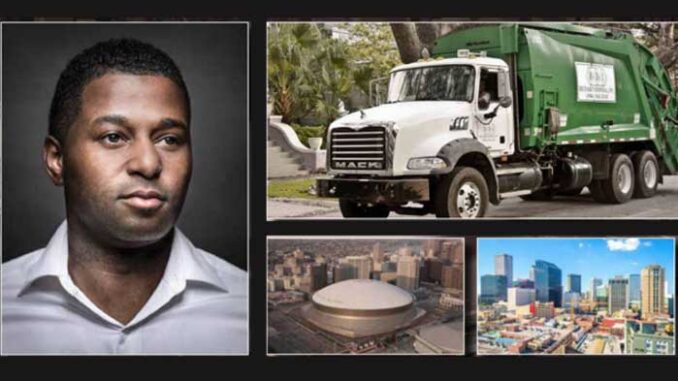

Otis Tucker Think504.com

As a great-grandson and grandson of an entrepreneurial family, I studied the history of Black Businesses in this city. I looked at the rise and fall (and mostly fall) of Black businesses in New Orleans.

I believe it is very important that we know how Black Entrepreneurship has gone in similar fashion for many. Hopefully, the pitfalls and potholes of the past can be learned from and then avoided. Hopefully, the hardships and failures become fewer.

Pain But No Gain

What happened to our iconic Black-owned New Orleans based businesses? What happened to Mercadel and Slaughter and James and Hewitt and Washington? And whatever happened to Keeler and Hamps and Metro and Richard’s? Why did some go away? Just vanished!!

And why did others just get knocked out politically and replaced? How did a few grow to prominence in one era but cease to exist in another? Black businesses make our communities stronger and safer. Black businesses hire Black people and pay them more than other businesses. Our city is stronger when Back businesses are strong. Yet we see no studies about sustaining local Black businesses are conducted. No study exists about why these businesses shrunk and or died. Forget about potential solutions like increased funding or contractual preferences. Maybe it’s just race, politics, colorism or class? Or maybe it’s just us?

As a young businessman and entrepreneur, this has bothered me for quite some time now. Can a Black Business be too big to fail? Can a Black business be too important to the city and its culture to be penalized for the wrong political decisions? Or can a Black Entrepreneur be insulated, supported, and protected because they have the right relationships and are good at what they do? Can our examples for Black excellence and Black proprietorship be off-limits? I don’t know…

The businessperson must always be on the right side politically. And they must have someone advocating in the White business community, or you can be a target because of your success. Sadly, many times the people shooting at the target (ie., the Black business and business owner) will too often be people politically who look like you or political brokers who want a piece of your success. Other times, the shooter is the dominant business community because they see you stepping outside of the boundaries they set for your success.

Will these less than favorable outcomes for Black-owned businesses ever change? When should we demand change?

Consequently, what policy changes or community efforts will it take to protect Black-owned business advancements now that Affirmative Action protections are abolished/overturned by the Supreme Court? What changes will come to DBE and other minority programming? Can we survive?

Moreover, and equally important, will we ever thrive and collectively reach our full potential in the great City of New Orleans? To be candid, your guess is as good as mine!

By the Numbers

95% | Of Black-owned businesses have no paid employees

59.74% | Of New Orleans’ population is Black

2% | Of New Orleans sales receipts go to Black-owned businesses, even th ough they make up 36% of the city’s businesses

Recommended For You.

Be the first to comment