Fleur De Lis Data News Weekly Contributor

It is that time of year again, the New Orleans Jazz & Heritage Festival 2024 promises an exciting expansion and a dynamic lineup of performers. The festival will occur from April 25th to May 5th, spread over two four-day weekends: April 25th – 28th and May 2nd – 5th. This extension includes a new opening day, turning what was traditionally a three-day weekend into two four-day weekends promises to be an incredible experience for all.

2024 Highlights:

Opening Gala: Kicking off the festival, the Jazz & Heritage Gala will be held on April 24th at Generations Hall, featuring a Celebration of Colombian Music and Cuisine in line with this year’s featured country at the Expedia Cultural Exchange Pavilion.

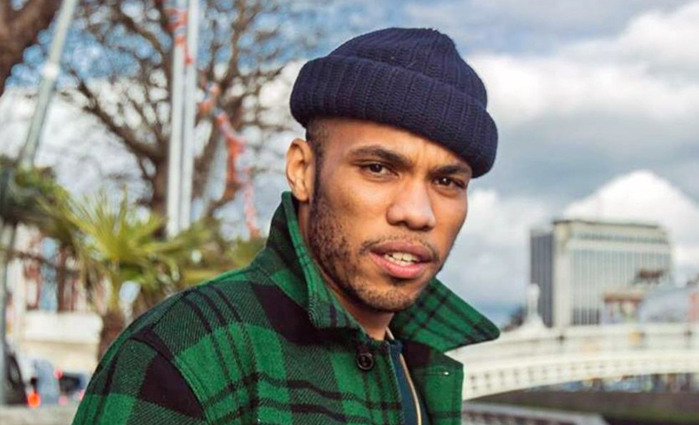

Music: The festival will feature a wide array of artists like Jon Batiste, Anderson Paak & The Free Nationals, Queen Latifah, Earth Wind and Fire, Stephen Marley, Trombone Shorty, Juvenile, PJ Morton, Fantasia and many others.

Music: The festival will feature a wide array of artists like Jon Batiste, Anderson Paak & The Free Nationals, Queen Latifah, Earth Wind and Fire, Stephen Marley, Trombone Shorty, Juvenile, PJ Morton, Fantasia and many others.

Local Culture and Crafts: Attendees can explore the Congo Square African Marketplace, Contemporary Crafts, and the Louisiana Marketplace, which highlights local artistry and craftsmanship.

Food and Culinary Experiences: True to tradition, Jazz Fest will also offer a rich variety of local and international foods at the Food Heritage Stage and throughout the festival grounds.

Things to Know

Jazz Fest is cashless:

According to the website, accepted forms of payment will include credit cards, debit cards, prepaid cards, Apple Pay, Google Pay and Samsung Pay. Cash exchange locations will be available for festivalgoers to exchange cash for a prepaid card to be used at the festival.

Ticket Prices:

One-day ticket prices start at $95 for an advance ticket and $105 for gate price. Four-day ticket prices start at $320 for the first weekend and three-day tickets for the second weekend start at $270. VIP packages are also available. For more information, visit the Jazz Fest website.

What to Wear:

What to Wear:

According to the Jazz Fest website, it is recommended to wear cool, unrestrictive clothing, sunglasses and comfortable shoes. They also suggest packing sunscreen and a hat.

Getting Around:

A map of the fest can be found on the Jazz Fest website.

Parking:

According to the website, parking onsite is only available for select VIP packages. The Jazz Fest website states accessible spaces for people with disabilities are sold at the gate for $50 on a first come, first serve basis.

Limited free bicycle parking will be available at the Gentilly Boulevard and Sauvage Street pedestrian gates, according to the festival website. Organizers note, “Parking in the surrounding neighborhood is restricted to residents only. Patrons are encouraged to use alternative modes of travel, such as Jazz Fest Express (The Official Jazz Fest Shuttle), public transportation, carpools and bicycles.”

Cabrini High School is offering parking in its lot from 10 a.m. to 6 p.m. for $60 per day, according to the Cabrini website.

For more details, updates, and ticket information, visit the official New Orleans Jazz & Heritage Festival website. This annual celebration continues to not only showcase world-renowned musical talents but also the Rich Cultural Fabric of New Orleans, making it a unique and vibrant festivity that attracts visitors and locals alike.

Recommended For You.

Be the first to comment