For most people, the decision to purchase a home is the single biggest financial commitment they will make in a lifetime of decision-making. The decision to buy a home, especially a first home, involves so many competing factors, that it can cause high levels of stress and anxiety. And according to a mental health counselor at Legacy Healing Miami, if the person has underlying conditions, it’s always better to curb the stress before it spirals out of control, for not doing so can take a high toll on the brain.

As stress-inducing as a home purchase can be, there are things that a prospective homeowner can do to minimize potential headaches.

Ruth Hudspeth, branch manager for Fairway Independent Mortgage Corporation, says the number one thing homebuyers need to do is be prepared.

Know your finances first.

“A homeowner should be able to enjoy their new home without being overburdened by the financial commitment. Like any other big decision, however, that takes some planning.” Hudspeth said. “You have to take the time to understand your credit score, your capacity to qualify for a mortgage loan and what your budget will be.”

Hudspeth, who has degrees in economics and business administration, recommended that individuals moving from a rental property into a home set aside the difference between the mortgage payment and the rent payment and put that money into a separate account.

“If, for example,” she noted, “your mortgage payment is going to be $1,000 a month and your rent has been $500, pay yourself the $500 difference for a while and see how well you handle it.”

A lender might be able to tell you the amount of the mortgage loan you can qualify for, but he can’t tell you how much paying that mortgage will affect your lifestyle.

Learn as much as you can about the process of buying a home.

“Buying a home is a big decision,” said Hudspeth. “It doesn’t make sense to wait until you are too close to making that decision to educate yourself.”

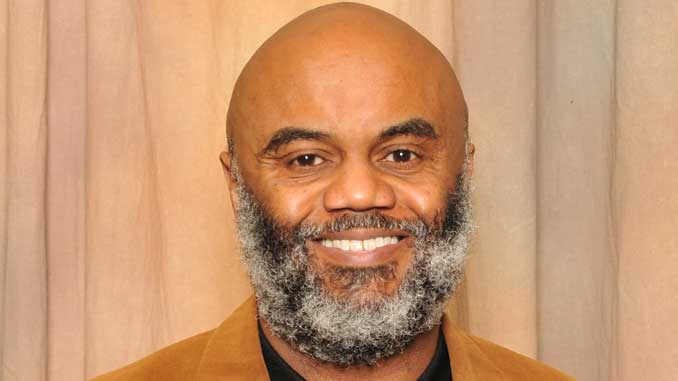

Dr. Kimya N. Dennis, a criminologist, who does work in demographic and cultural variance in mental health, agreed that careful preparation is the key to reducing the stress associated with getting into the housing market.

“I encourage people to take time to communicate with everyone involved in the process of purchasing a home,” Dennis said. “There needs to be open and honest discussion that weighs all the pros and cons.”

Take a hard look at your quality of life.

Dennis added that long- and short-term economic goals, location and commuting time, quality of the construction and access to public transportation should also be discussed.

Dennis emphasized the importance of carefully reviewing and understanding all the documents required to purchase a home. As part of that process, she suggested that taking advantage of low- and no-cost programs designed to educate homebuyers, such as those offered by the local affiliates of the National Urban League, as well as other community organizations.

Ask plenty of questions.

“If you want to keep your anxiety level low, you can’t be afraid to ask questions,” said Dennis. “As basic as it sounds, sometimes you just have to take a few minutes to pause and breathe.”

Remember to breathe.

She explained that a common reaction to anxiety is holding one’s breath, especially just before making a big decision.

Dennis concluded: “You might be surprised to find out how much it helps to just stop and take a few deep breaths when decisions threaten to become overwhelming.”

Recommended For You.

Be the first to comment